Mobile services represent critical infrastructure that’s allowing people to stay connected during the coronavirus crisis. However, that doesn’t mean these services are immune to the pandemic’s economic shock, with 2020 market revenue now expected to come in about $51 billion short of the previous forecast, according to Omdia.

Worldwide mobile communications services market revenue will total $749.7 billion this year, down from the prior forecast of $800.3 billion. This compares to $781.5 billion in 2019. Annual revenue will fall by 4.1 percent this year, with the decline amounting to $31.8 billion.

“Mobile phone companies around the world are experiencing usage spikes as more countries encourage or enforce social distancing and work-from-home rules to slow the spread of the COVID-19,” said Mike Roberts, research director at Omdia. “However, the spikes aren’t enough to overcome the impact of the pandemic on consumer behaviour. These rules are having a dramatic impact on various regions of the world, halting new subscriptions and upgrades in the United States, while slashing revenue for operators in Europe.”

Consumer uptake of 5G will be slower than previously forecasted, due to the economic situation as well as the possibility of delays in 5G network deployment and in the availability of 5G devices. Omdia will release more details on 5G shortly. 5G worldwide subscriptions will be down 22.1 percent versus the previous forecast.

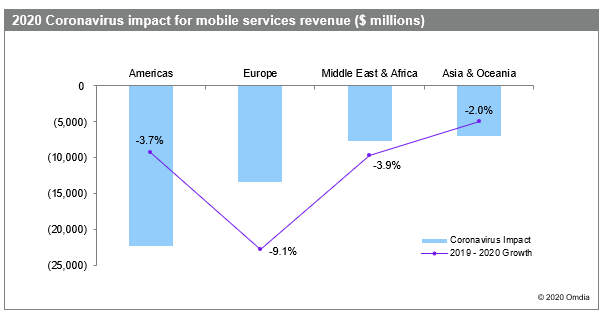

In the Americas, mobile service revenue is set to decline by 3.7 percent to $237 billion in 2020. Most of that loss will come in the United States as both net additions and upgrades to higher data plans slow or stop altogether.

Europe will suffer the largest impact of the crisis, with mobile service revenue falling 9.1 percent to $131 billion, representing a downgrade of 9.3 percent compared to Omdia’s previous forecast. This decline will be driven by significant reductions in mobile prepaid revenue and a dramatic drop in inbound roaming revenue.

Vodafone UK, for example, said mobile Internet traffic has increased by 30 percent and mobile voice traffic by 42 percent due to the crisis. At the same time, mobile service providers are seeing new business grind to a halt as retail stores close and consumers stop buying new phones as job losses mount. One example of this widespread trend is AT&T, which is closing 40 percent of its retail stores in the United States.

The Middle East and Africa will see a 3.9 percent decline in mobile service revenues to $84 billion, representing a downgrade of 8.4 percent from Omdia’s previous forecast. Major factors for the decline include the impact of low oil prices on Gulf economies and the fragility of economies and health care systems in parts of Africa.

The high-income Gulf countries have been early movers with 5G in the Middle East and globally, having all launched commercial 5G services in the second half of 2019. However, the economic impact of the crisis is likely to hit consumer confidence and appetite for expensive 5G devices, and mobile 5G subscriptions in the Middle East will be significantly lower at the end of 2020 than expected previously.

Even before the COVID-19 crisis, the number of mobile 5G subscriptions in Africa was expected to be very small at end-2020. Now it will be even lower as a result of the economic consequences of the pandemic and likely disruption to 5G network deployment plans.

While the impact of the coronavirus on the mobile market is significant in every region, it pales in comparison to the impact the crisis is having on sectors such as travel, tourism, hospitality and retail, which have suffered partial or complete shutdowns. The International Monetary Fund now expects the global economy to contract by 3 percent in 2020, according to its latest World Economic Outlook, which was released earlier this month.

“The massive contraction will clearly impact every segment of the economy, including mobile, but how long it will last in each country and region is virtually impossible to predict,” Roberts said. “One bright spot is that in China, the first country hit by the pandemic, there are signs that the mobile market and broader economy is starting to come back to life.”

Given the high level of economic and commercial uncertainty created by the COVID-19 pandemic, Omdia will be producing a full revision of its global mobile forecasts next quarter.